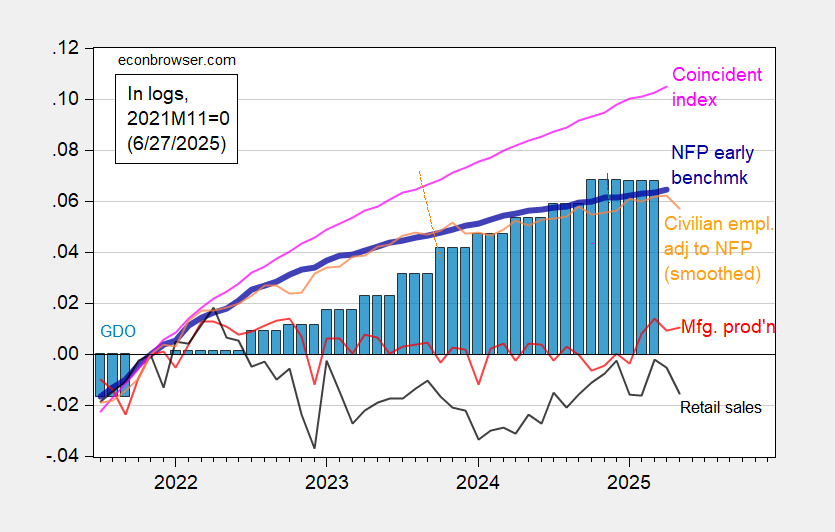

Private revenue, consumption each down in Might, with at this time’s launch. Industrial manufacturing, civilian employment in NFP idea down from earlier releases. Month-to-month GDP from SPGMI and manufacturing and commerce trade gross sales down in April…it’s cheap to ask whether or not that is all signaling one thing.

First up, indicators adopted by the NBER Enterprise Cycle Courting Committee (BCDC). The BCDC locations main emphasis on the employment and revenue sequence.

Determine 1: Nonfarm Payroll incl benchmark revision employment from CES (daring blue), civilian employment utilizing smoothed inhabitants controls (orange), industrial manufacturing (purple), private revenue excluding present transfers in Ch.2017$ (daring mild inexperienced), manufacturing and commerce gross sales in Ch.2017$ (black), consumption in Ch.2017$ (mild blue), and month-to-month GDP in Ch.2017$ (pink), GDP (blue bars), all log normalized to 2021M11=0. 2025Q1 GDP is third launch. Supply: BLS by way of FRED, Federal Reserve, BEA, S&P World Market Insights (nee Macroeconomic Advisers, IHS Markit) (6/2/2025 launch), and creator’s calculations.

Complete nominal private revenue at -0.4% m/m was beneath Bloomberg consensus improve +0.3, whereas nominal consumption spending was beneath (-0.1% m/m vs. +0.1%)

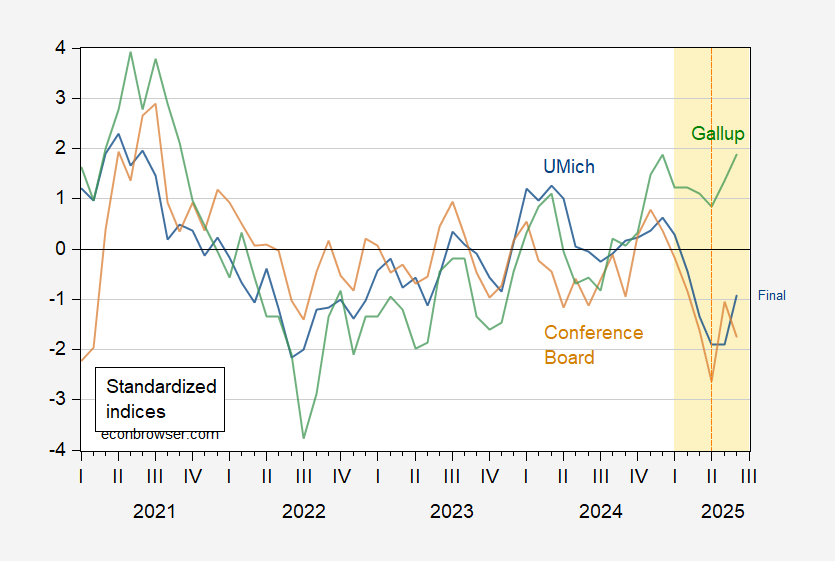

Determine 2: Preliminary Nonfarm Payroll early benchmark (NFP) (daring blue), civilian employment adjusted to NFP idea, with smoothed inhabitants controls (orange), manufacturing manufacturing (purple), actual retail gross sales (black), and coincident index in Ch.2017$ (pink), GDO (blue bars), all log normalized to 2021M11=0. Supply: Philadelphia Fed [1], Philadelphia Fed [2], Federal Reserve by way of FRED, BEA 2025Q1 third launch, and creator’s calculations.

Basically, I put a lot heavier weight on the CES vs. CPS measures of employment. Nevertheless, should you’re a believer that the CPS sequence alerts recessions sooner than the CES, nicely, time to begin worrying (there’s really solely blended proof in help of this view, utilizing real-time knowledge, see this submit).

The falloff in (chained CPI deflated) retail gross sales can also be suggestive of a tiring client, which might not be shocking given the comparatively low ranges of client sentiment.

Determine 3: U.Michigan Financial Sentiment (blue), Convention Board Confidence Index (brown), Gallup Confidence (inexperienced), all demeaned and divided by normal deviation 2021M01-2025m02. Dashed line at “Liberation Day”. Supply: UMichigan, Gallup, Convention Board, and creator’s calculations.

Keep forward of the curve with Enterprise Digital 24. Discover extra tales, subscribe to our e-newsletter, and be part of our rising group at bdigit24.com