From GDP Q1 third launch and nowcasts plus monitoring. GDPNow is down on private revenue and spending launch, superior financial indicators, in addition to the Q1 third launch.

Determine 1: GDP (daring black), Could SPF median (tan line), GDPNow (sky blue sq.), Goldman Sachs (blue sq.), NY Fed (inexperienced triangle), St. Louis Information nowcast (inverted crimson triangle), all in bn.Ch.2017$, SAAR. Supply: BEA 2025Q1 third launch, Atlanta Fed, Goldman Sachs, NY Fed, St. Louis Fed, and creator’s calculations.

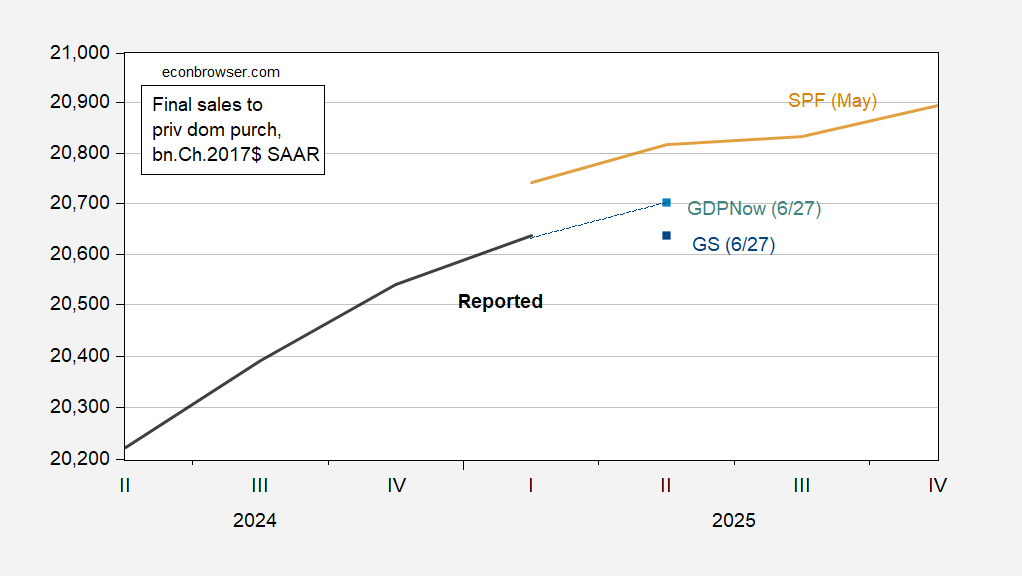

Given the distortions attendant with tariff front-loading and stock monitoring, it pays to consider mixture demand (in precept measured by last gross sales), or pattern mixture demand (in precept measured gross sales to home purchasers, so consumption and stuck funding. That is proven in Determine 2, together with nowcast from GDPNow and Goldman Sachs monitoring.

Determine 2: Last gross sales to personal home purchasers (daring black), Could SPF median (tan line), GDPNow (sky blue sq.), Goldman Sachs (blue sq.), all in bn.Ch.2017$, SAAR. Supply: BEA 2025Q1 third launch, Atlanta Fed, Goldman Sachs, and creator’s calculations.

Clearly, there’s deceleration on this measure, and nowcasted slowing. Apparently, Goldman Sachs thinks last gross sales to personal home purchasers shall be flat this quarter.

Keep forward of the curve with Enterprise Digital 24. Discover extra tales, subscribe to our publication, and be part of our rising group at bdigit24.com