US preliminary jobless claims pulled again final week as persevering with claims continued rising. The variety of People amassing unemployment insurance coverage on a recurring foundation rose to the very best stage in 3-1/2 years — a doable warning signal for the labor market. “The info are per softening of labor market circumstances, notably on the hiring aspect of the labor market equation,” stated Nancy Vanden Houten, lead economist at Oxford Economics. “For now, we don’t assume the labor market is weak sufficient to immediate the Fed to chop charges earlier than December, however the danger is growing that after the Fed begins to decrease charges, it should have some catching as much as do.”

Revised GDP knowledge for the primary quarter present that the US financial system shrank greater than beforehand estimated. Output fell 0.5% in Q1 vs. the 0.1% for the sooner estimate, based on the Bureau of Financial Evaluation.

The US commerce deficit elevated 11% in Could as exports decreased and imports remained comparatively unchanged, the Commerce Division’s Census Bureau reported. The slide in US exports was sharp, falling in Could on the steepest price because the coronavirus disaster in 2020.

The Chicago Fed Nationwide Exercise Index picked up in Could, however the present studying nonetheless exhibits a below-trend profile for the US financial system. Two of the 4 broad classes of alerts used to assemble the financial exercise gauge elevated sequentially final month, although three classes made adverse contributions over the identical interval.

China stated it might approve the export of uncommon earth minerals to the US. Earlier, White Home officers stated the 2 sides had reached a deal. The agreements marks main breakthrough after weeks of negotiations over US entry to the important thing supplies produced in China.

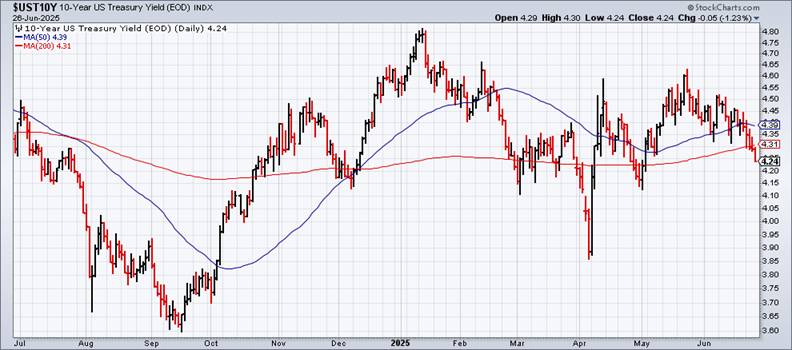

US 10-year Treasury yield falls to 4.24%, lowest in almost two months. Fed funds futures are pricing in a roughly 90% likelihood that the central financial institution will begin reducing charges in September.

Keep forward of the curve with Enterprise Digital 24. Discover extra tales, subscribe to our publication, and be a part of our rising group at bdigit24.com